epf withdrawal i sinar

Do note that you are only allowed to make the amendment once. He said for members who had already applied for i-Sinar under the current criteria their applications would be automatically approved in due course.

Epf Approves Rm19 62 Billion Worth I Sinar Applications Businesstoday

Let them withdraw all lah.

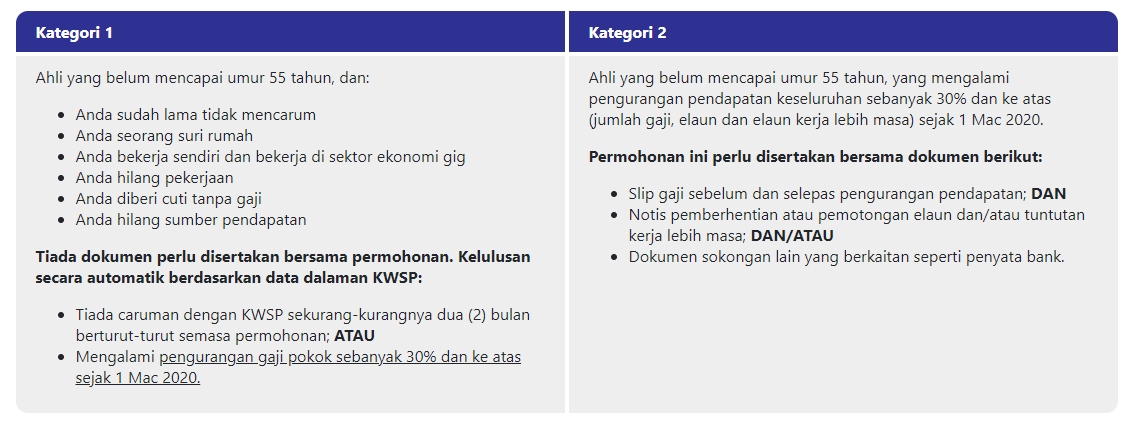

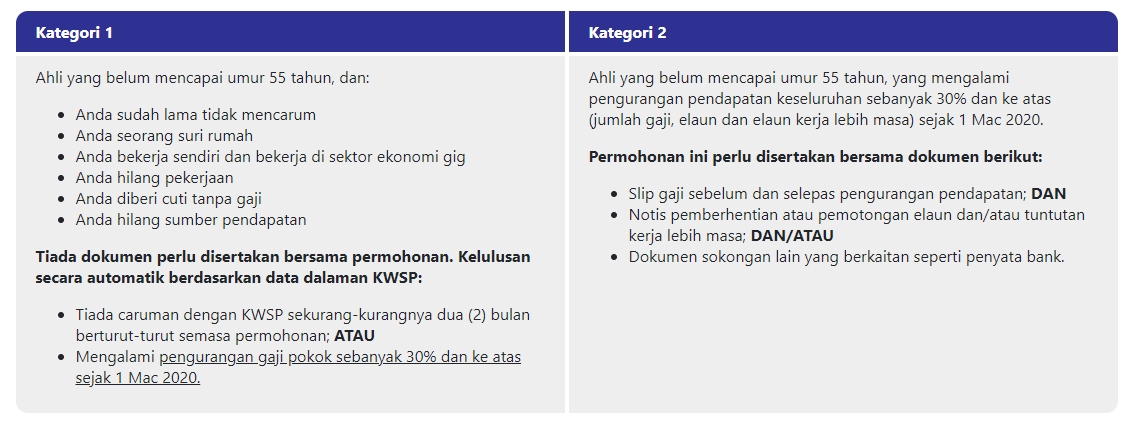

. The Employees Provident Fund EPF is in the process of lifting several conditions for the i-Sinar withdrawal facility which among others will allow contributors under the age of 55 to withdraw from their Account 1 funds. The Employees Provident Fund EPF has revealed full details for the i-Sinar program which will allow eligible members to make withdrawals from Account 1. The Employees Provident Fund EPF has will open registrations for i-Sinar starting 21 December.

1 According to EPF this has resulted in 61 million members having less than RM 10000 currently in their savings and a staggering 79 of them having less than RM 1000 left consequently. According to reports i-Sinar allows EPF members to withdraw funds from Account 1 that is usually only accessible once members turn 55 years old. Show posts by this member only Post 1.

This initiative was launched by the EPF for the purpose of easing the financial burden of members whove been affected by the Covid-19. Payments will be staggered over a maximum period of. Junior Member 38 posts Joined.

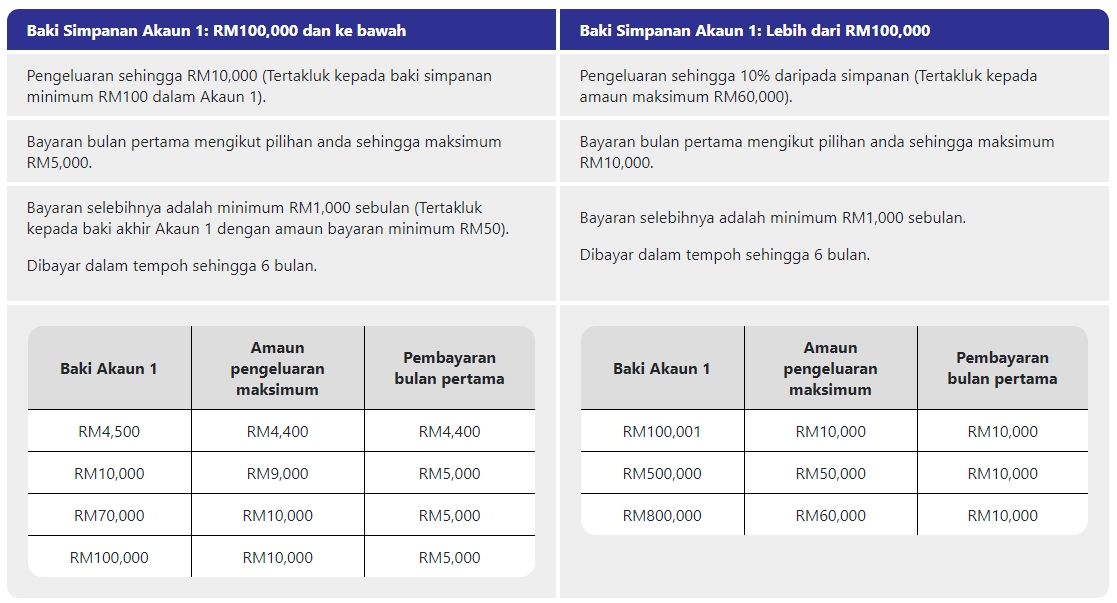

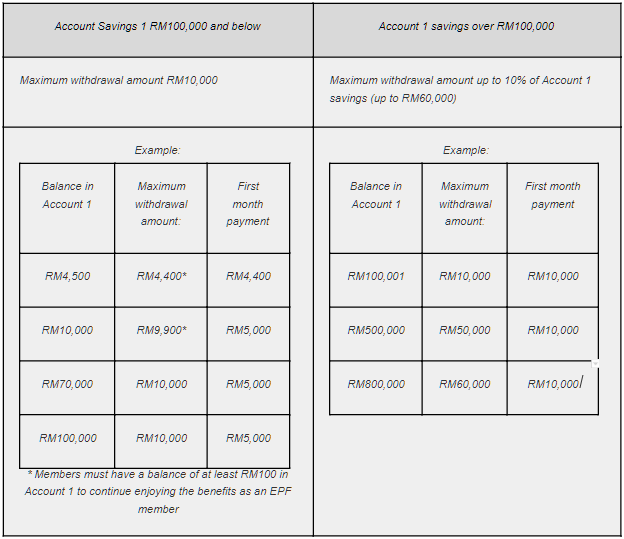

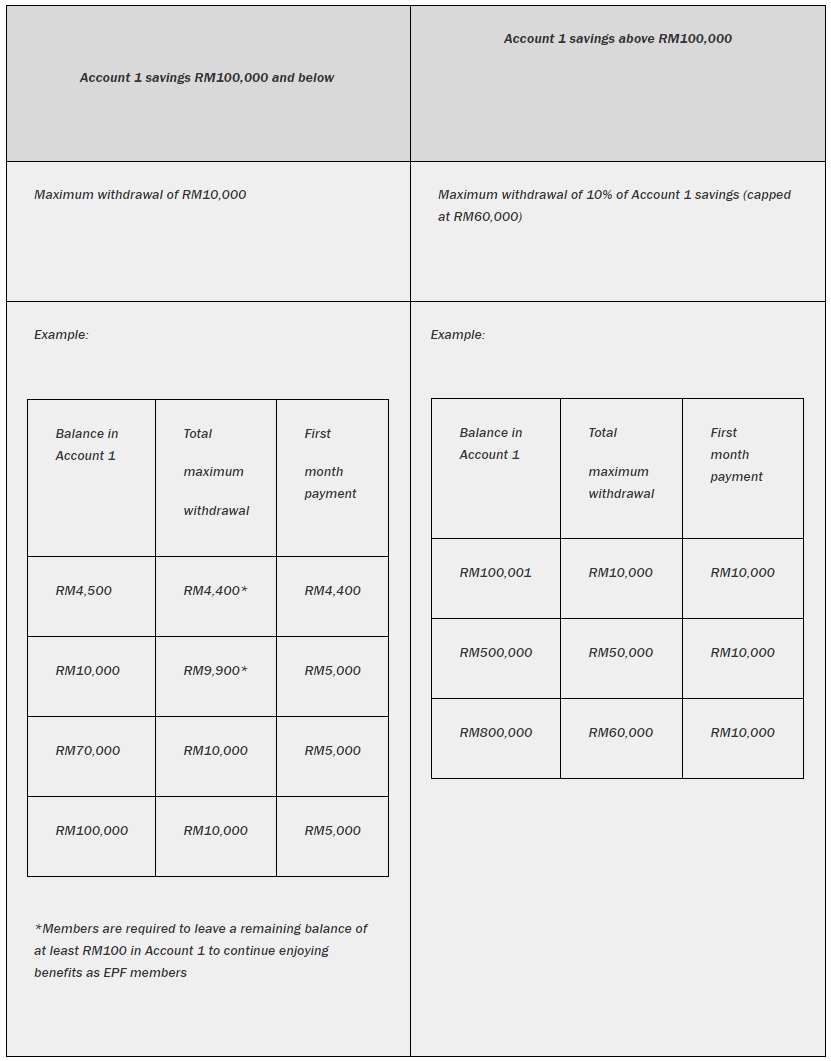

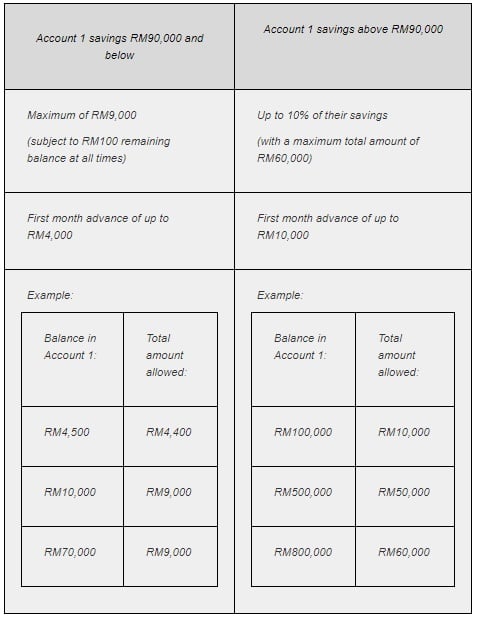

For further information members may contact the i-Sinar hotline at 03-8922 4848. The eligible amount for i-Sinar is subject to the members Account 1 balance based on the latest details below. It is an extension of the previous i-Lestari Account 2 withdrawal programme that ends in March 2021.

He had said that the implementation of four facilities introduced to tackle problems brought by the Covid-19 pandemic namely i-Lestari i-Sinar i. For those with they can withdraw any amount up to RM10000. For those with more than RM100000 may withdraw up to 10 of their account balance with a maximum cap of RM60000.

This was done via the i-Lestari i-Sinar and i-Citra schemes which resulted in a total withdrawal of RM 101 billion by 74 million members. The payments will be staggered over a period of six 6 months with the first payment of up to RM10000. The i-Sinar program was introduced to assist members who are affected by the current pandemic situation.

The removal of conditions will allow EPF members under the age of 55 to withdraw from their Account 1 funds subject to their existing balance Tengku Zafrul said in a statement today. I wonder how it was possible for the i-Sinar i-Lestari and i-Citra Employees Provident Fund withdrawal schemes to be permitted given the limited franchise of withdrawals allowed under the EPF Act 1991. From what I understand EPF withdrawals were only allowed for contingencies such as the purchase of a house education and medical treatment and upon.

A total of RM145bil was withdrawn by EPF members under the four Covid-19-related programmes namely i-Lestari April 2020 i-Sinar December 2020 i-Citra July 2021 and. EPF full withdrawal I Sinar 20 Bantu rakyat dengan duit rakyat. However the amount withdrawn will be subject to the account balance.

For members that have RM100000 or less in Account 1 you are only allowed to withdraw up to RM10000. Affected members who wish to take out funds are able. Jun 7 2021 1020 AM updated 2y ago.

February 15 2022 By Associate Professor Dr Hafezali bin Iqbal Hussain During the past two years Malaysians have been allowed to make several rounds of withdrawals from their EPF savings. This was done via the i-Lestari i-Sinar and i-Citra schemes which resulted in a total withdrawal of RM 101 billion by 74 million members. However the maximum total amount withdrawal allowed is RM60000.

The EPF i-Sinar initiative enables EPF members to make a partial withdrawal from their savings in EPF Account 1. The i-Sinar withdrawal will be paid out across a period of 6 months. In general the withdrawal will add liquidity to the countrys economy and this should give a boost to economic activities as Malaysians have a high tendency to spend Yesterday the EPF said it expects the i-Sinar facility to benefit two million eligible members with an estimated advance amount of RM14 billion to be made available.

Speak truthfully Gov need to relook what they are doing People with EPF less than 20k saving.

I Sinar A Rm56bil Question Mark The Star

I Sinar Category 2 How To Apply And Eligibility Comparehero

Updated I Sinar Program Details Epf Members Can Start To Apply I Sinar Starting From 21 Dec 2020 News Puchong Co

Epf I Sinar Account 1 Withdrawal Here S Everything You Need To Know Soyacincau

I Sinar 8 Other Things You Can Use Your Epf For

I Sinar Epf Allows Account 1 Withdrawal Up To Rm60 000 Here S How Trp

Epf I Sinar Applications Are Now Open For Category 1 Here S How To Apply

I Sinar Epf Allows Account 1 Withdrawal Up To Rm60 000 Here S How Trp

I Sinar The Pros And Cons Of Withdrawing Money From Your Epf Account Rojakdaily

Epf I Sinar Account 1 Withdrawal Here S Everything You Need To Know Soyacincau

Epf I Sinar Account 1 Withdrawal Here S Everything You Need To Know Soyacincau

I Sinar 8 Other Things You Can Use Your Epf For

Bernama Epf Offers Further Details On I Sinar In Response To Media Query

Epf I Sinar Unconditional Withdrawal Lower Epf Dividend 2021 Otosection

Epf I Sinar Akaun 1 Advance Facility What You Need To Know

I Sinar Epf Allows Account 1 Withdrawal Up To Rm60 000 Here S How Nestia

Epf I Sinar Account 1 Withdrawal Here S Everything You Need To Know Soyacincau

I Sinar Category 2 How To Apply And Eligibility Comparehero

Epf Account 1 Withdrawal I Sinar The Pros And Cons

0 Response to "epf withdrawal i sinar"

Post a Comment